working capital turnover ratio calculator

It means the cycle should never stop for the lack of liquidity whether it is for buying raw material salaries tax payments etc. The primary objectives of working capital management include the following.

Activity Ratio Formula And Turnover Efficiency Metrics

It only makes sense the vendors and creditors would like to see how much current assets assets that are expected to be converted into cash in the current year are available to pay for the.

. Accounts Receivable Turnover Ratio Explained. Much like the working capital ratio the net working capital formula focuses on current liabilities like trade debts accounts payable and vendor notes that must be repaid in the current year. The formula for a stock turnover ratio can be derived by using the following steps.

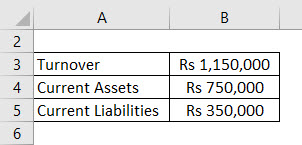

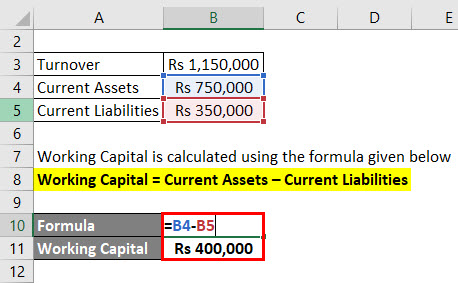

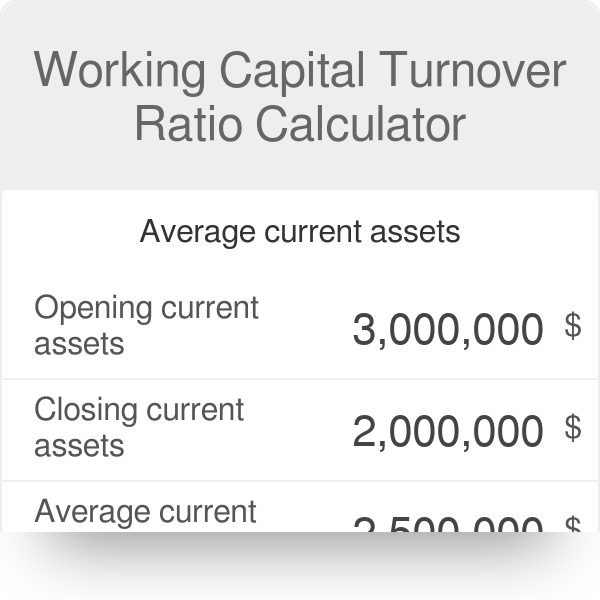

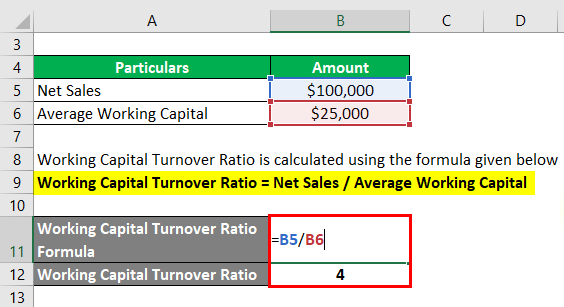

Working Capital Turnover Ratio. Working Capital Turnover Ratio is an efficiency ratio that measures the efficiency with which a company is using its working capital in order to support the sales and help in the growth of the business. It is the relation between the amount of a companys assets and the revenue generated from them.

Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product. Working toward and attaining financial security requires businesses to understand their accounts receivable turnover ratio. Working capital is very essential for the business.

It is defined as the difference between the current assets. To be more precise it is an efficiency ratio to check how efficiently the company is using different assets to extract. Objectives of Working Capital Management.

This efficiency ratio takes an organizations receivable balances and receivable accounts into consideration to determine the state of its cash flow. Apple Inc Balance sheet Explanation. The key objective of working capital management is to ensure a smooth operating cycle.

If a companys receivables turnover goes. The turnover ratio can be defined as the ratio to calculate the quantity of any asset which is used by a business to generate revenue through its sales.

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula Calculator Excel Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Asset Turnover Ratio Plan Projections

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Meaning Formula Calculation

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Working Capital Turnover Ratio Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

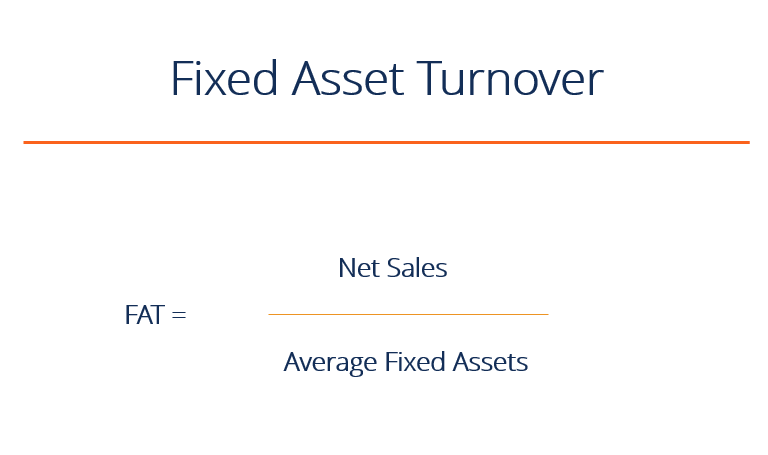

Fixed Asset Turnover Overview Formula Ratio And Examples

Working Capital Turnover Ratio Meaning Formula Calculation

How To Find Net Working Capital Formula

Working Capital Turnover Efinancemanagement Com

Efficiency Ratios Archives Double Entry Bookkeeping

Working Capital Turnover Ratio Different Examples With Advantages